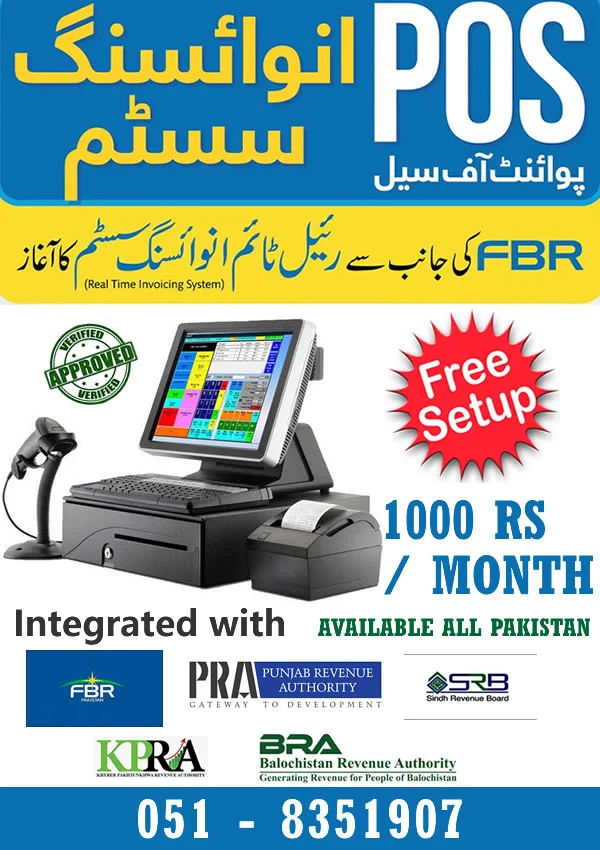

معزز صارف، ہم پاکستانی کاروبار، تاجر حضرات وٹریڈرذ کے لیے *ایف بی ار سے منسلک انوائسنگ سسٹم* فراہم کرتے ہیں۔ یہ سسٹم ہر قسم کے کاروبار کے لیے موزوں ہے۔ اس سسٹم کا *سیٹ اپ فری* جبکۓ ماہانہ فیس 2500 روپۓ ماہانہ ہے - ڈیمو اور مزید معلومات کے لیے یہاں کلک کریں

AVAILABLE ALL OVER PAKISTAN

Watch Demo Video | Watch Help Video

* MOBILE APP IS AVAILABLE

Suitable for remote sales, distributors, supply chains and places where desktop setup is not feasible .IN COMPLIANCE WITH S.R.O. 709(I)/2025

Tel: 051-8351907

WhatsApp: 03 49 59 25 35 0

FBR POS Software

FBR Integrated electronic invoicing system

- Complete FBR Integrated POS System and FBR Integrated Digital invoicing system

- Includes Inventory management, sales and returns modules

- Fully Integrated with FBR API Version 1.3

- Report 236 WTH, FED, Advance Tax and GST

- Includes Barcode support

- GST Invoice format Pakistan

- Dual or complete Integration With PRA EIMS, SRB, KPRA or BRA EIMS

- Suitable for Tier-1 retailers, wholesalers, FMCG Sector, restaurants, hotels and all other kind of businesses.

- Free Setup All Over Pakistan

- Easy Monthly Payment of 1000 Rs Only

- No Hidden or extra charges

- Remote Installation in 2 -3 hrs

- Available in all cities of Pakistan

FBR POS Integration

Integrate your existing POS System or Online Store / Website with FBR

- Complete POS FBR Integration of your current POS / ERP system

- Fbr Integration for online website/ eCom store or social media business

- Fully Integrated with FBR API Version 1.3

- Integration of payment / sales / refunds printing and emailing modules and templates

- Re design your sales receipt to Show QR Code and fiscal Invoice number

- Cheapest Customization charges

- Support for VB , Java, PHP, ASP, ORACLE and .Net Technologies

- For Online shops - BigCommerce, Opencart, Magento, Woocommerce and Shopify frameworks

- Re-sale of Customised Software is not allowed.

- Important Warning - Must Read

We have integrated Tier-1 retailers with FBR and have active clients in Islamabad, Rawalpindi, Jhelum, Sialkot, Faisalabad, Karachi, Multan, Kasur, Peshawar, Lahore, Shakargarh, Mirpurkhas, Quetta, Abbottabad and many other cities all over Pakistan. We Provide our FBR POS Invoicing system, FBR Integrated electronic invoicing system and FBR POS Integration software all across Pakistan.

Number of FBR POS Clients

Number of Sale Transactions Reported

Amount of Sales Reported to FBR

Amount of Sales Tax Reported to FBR

FBR POS System (Cost)

FBR POS Software (Modules)

FBR POS Software

* Suitable for Shops, Retailers and all those businesses that want to use fully integrated FBR Point of Sale Software.

| Best for: | Retailers, Wholesalers, Restaurants, Super stores, Hotels, Auto Showrooms, Boutiques, Mobile Phone stores, Furniture stores, Corporate companies etc |

| Prices: | 1500 Rs/Month only (No Hidden or extra charges) |

| FREE: | FREE POS Integration, FBR Digital Invoicing Integration |

| Updates: | FREE Regular updates and maintenance to incorporate latest tax laws / S.R.Os |

Verified By: Verified By: | FBR, PRA, SRB, KPRA,BRA |

| Extras: | Multiple branch support, Barcode support and 15+ Reports etc |

| Improves: | 100 % FBR Compliance and Complete Business Management |

| Invoice Type: | GST, 3rd Schedule, SRO 297(I)/2023 – (Sales and Returns both) |

| Taxes: | Multiple TAX brackets. Restaurant TAX discounts for Cash (15%) or Credit card (5%) payments. |

| Modules: | Inventory management, Customers, Sales, Returns, Reports, Taxation, Accounting etc |

| Integration: | FBR, PRA, SRB, KPRA, BRA |

| Availability: | Pakistan (All cities) |

| Time: | Same day installation |

FBR POS Integration

* Suitable for businesses that already have an invoicing or POS System in place and just want to integrate their current POS System with FBR Fiscal module.

A key benefit of integrating your current point of sale or invoicing system with the FBR sales tax system is that it allows Pakistani Tier-1 retailers or sales tax registered retailers notified by FBR to automatically upload sales invoices and returns (credit notes) to the FBR servers. Our FBR Integrated electronic invoicing system can help to reduce the cost of taxation services by automating the preparation of the Sales Tax Return (STR) and issue a real-time verifiable electronic sales tax invoices for every taxable supply and service made. Tier3 technical team can integrate your existing POS or invoicing system with the FBR, PRA or SRB as required following the preset Boards standards.

If you are a whole seller, distributor, manufacturer or a supplier in FMCG sector then you should read about our FBR digital invoicing integration which is more suitable FBR integrated ERP System for your business.

We maintain complete FBR compliance and ensure ‘0 percent policy’ for invoices to be reported in Invoice Risk Management System (IRMS). Our development team has already successfully integrated FBR POS Invoicing System using ASP/PHP/.NET/JAVA and Oracle-based POS systems in Pakistan.

If you have a custom-made software or have purchased it from a vendor such as Codecanyon or another online software vendor, our FBR POS integration or FBR digital invoicing integration will ensure that your system is capable of reporting sales data to the FBR, printing the fiscal invoice number and QR Code on your sales receipts, and updating the database for future reporting.

* Important Warning: (subsection (9A) of section 3 and section 40C)

Any person, who is integrated for monitoring, tracking, reporting or recording of sales, production and similar business transactions with the FBR or its computerized system, conducts such transactions in a manner so as to avoid monitoring, tracking, reporting or recording of such transactions, or issues an invoice which does not carry the invoice number or barcode or QR code or bears duplicate invoice number or counterfeit barcode or QR code or any person who abets commissioning of such offence shall pay a penalty of five hundred thousand rupees or two hundred per cent of the amount of tax involved,whichever is higher. He shall, further be liable, upon conviction by a Special Judge, to simple imprisonment for a term which may extend to two years.

We respect you and your business. Please extend the same courtesy to us. Do not waste our time by asking us for modification or customizations that will fall under the above mentioned section. No such requests will be entertained; not even for testing or demo purpose.

Thank you.

FBR POS Integration For Online Marketplace and Social Media Businesses

As per sales tax rules all businesses operating online through a registered domain name/ website or using any social media platforms (Facebook, whatsapp, instagram etc) should also be connected to FBR POS invoicing system. This implies that all the sales and returns to be recorded and transmitted through point of sale in real-time to Board’s Computerized System through a prescribed integration software.

According to Sales Tax Rules such website or online stores shall be registered with the FBR Computerized System with following details, namely:–

(a) domain name;

(b) domain name provider;

(c) name of service provider managing the website; and

(d) addresses of supply centres and warehouses.

Our technical team has successfully integrated online shops and websites with FBR operating with BigCommerce, Opencart, Magento, Woocommerce and Shopify frameworks. We can also integrate your own custom developed shop as long as you have the complete source code and database access. Our development and integration teams consist of FULL Stack Developers (asp, php, react, .net, javascript) hence making sure that you have 100% integration functionality without any changes to design or compromising front end UI and UX of your online store.

Sales made through social media portals also need to be recorded and transmitted through FBR integrated point of sale in real-time. Social media businesses and retailers can opt for our standalone FBR POS Invoicing system to report and record daily sales in real time as per law. Find out more about Online Marketplace FBR Integration.

Feel free to contact us with your queries about our FBR POS Software.